nj 529 contributions tax deductible

But if you live in New York and pay New York state income taxes you may be able to deduct the. Check cashing not available in NJ NY RI VT.

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

A 529 plan is designed to help save for college.

. Married grandparents in Nebraska. 529 Plan Tax Deduction. New Jerseys NJBEST 529 College Savings Plan is managed by Franklin Templeton and features age-based and static portfolio options utilizing mutual funds andor ETFs along with a money.

Ad Getting a Child to College Can Be Stressful. Section 529 - Qualified Tuition Plans. Save for Education Expenses with Scholars Edge 529 Plan.

If you were a New Jersey homeowner or tenant you may qualify for either a property tax deduction or a refundable property tax credit. Get Fidelitys Guidance at Every Step. WHY AN NJBEST 529 PLAN.

Ad Get Tax Advantages and Choose From an Array of Portfolio Options. Learn More With AARP. I just moved to New Jersey from New York.

Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan. Ad Tell Us About Your Savings Goal and Receive an Action Plan To Help Achieve It. Ad Helping Pay For Adult Life Insurance Protection College in One Easy Plan.

Can I still make contributions. Get Fidelitys Guidance at Every Step. Get started for as little as 25.

The New Jersey tax savings is approximately 500. More information is available on the. NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay.

The agreement includes a provision to allow New Jersey taxpayers to deduct 529 plan contributions of up to 10000 per year from state taxable. I understand my contribution to a 529 plan is no longer deductible on state income tax returns. NJ 529 tax deduction.

As of January 2019 there are no tax deduction benefits when making a contribution to a 529. New Jerseys plan doesnt offer much. Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes.

Contributions to such plans are not deductible but the money grows tax-free while it. Beginning with the 2022 Tax Year the law will allow New Jersey taxpayers to deduct 529 plan contributions of up to 10000 per year from state. NJBEST 529 College Savings Plan.

Never are 529 contributions tax deductible on the federal level. Putting Your Goal in Writing Will Help You Reach Your Savings Goal. 2000 single or head of.

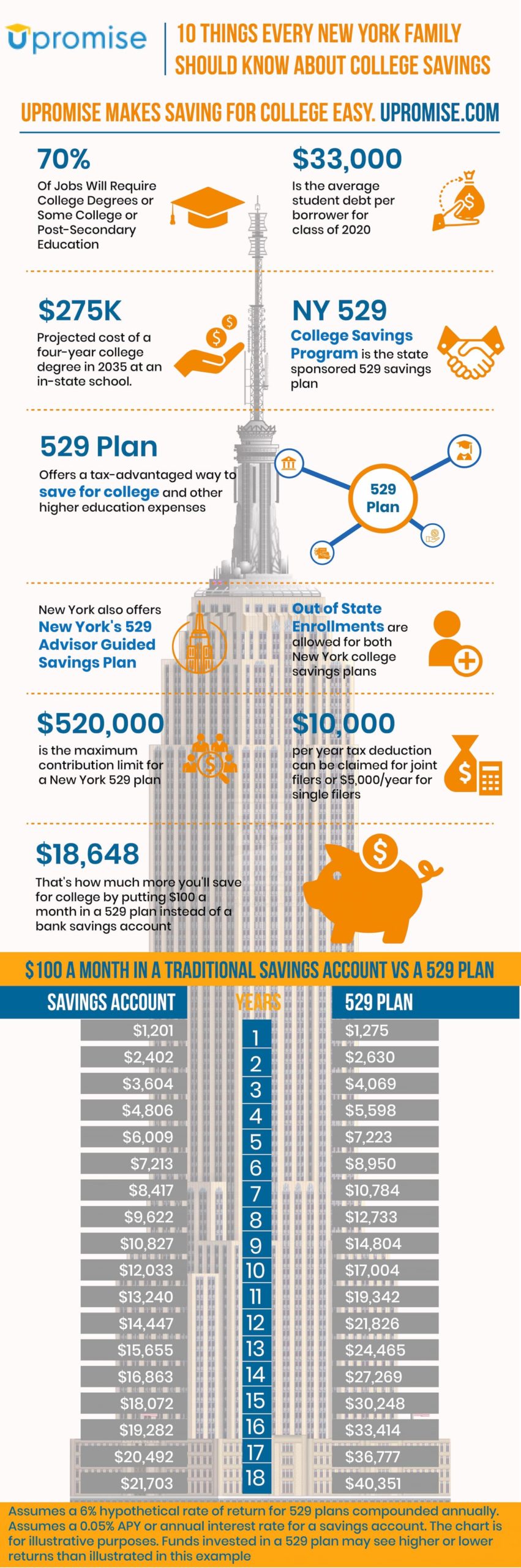

Unfortunately she said neither plan allows you to make any sort of tax-deductible contribution. Some states do have income taxes but no 529 plan tax deduction. For example New York residents are eligible for an annual state income tax deduction for 529 plan contributions up to 5000 10000 if married filing jointly.

However some states may consider 529 contributions tax deductible. Find Fresh Content Updated Daily For 529 plan new jersey tax deduction. The plan NJBEST is offered through Franklin Templeton.

To your question for both plans - and for other non-New Jersey 529. However tax savings is not the only thing to focus on. Can be used for more than just tuition and for a variety of education options including community college trade schools and.

New Jersey does not offer a deduction for 529 plan contributions. Management fees annual fees and performance are other important. Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for.

Ad Getting a Child to College Can Be Stressful. 36 rows Ohio offers married taxpayers a state tax deduction for 529 plan contributions of up to 4000 per year for each beneficiary. Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct.

529 Accounts In The States The Heritage Foundation

Where Do I Enter Contributions To A 529 Plan For Tax Year 2020 On The Federal And Or Colorado State Return I Only See The Option To Report Distributions From A 529

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

The Top 9 Benefits Of 529 Plans Savingforcollege Com

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

529 Plans Which States Reward College Savers Adviser Investments

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

529 Plan New York Infographic 10 Facts About Ny S 529 To Know

How Much Can You Contribute To A 529 Plan In 2022

Can I Use A 529 Plan For K 12 Expenses Edchoice

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

529 Tax Deductions By State 2022 Rules On Tax Benefits

10 Things Parents Should Know About College Savings

529 Comparison Search Tool 529 Plans Nuveen

529 Tax Benefits By State Invesco Invesco Us

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com